-

-

Modifications, Body Kits, Suzuki-Swift-2022

Buy Suzuki Swift OEM Body Kit 2022-2023

₨69,0000 out of 5 -

-

-

Body Kits, Toyota-Fortuner-2012-2016

Toyota Fortuner Body Kit Lexus Style 2012-2016

₨155,0000 out of 5 -

Body Kits, Honda-Civic-2022

YOFER Style Body Kit For Honda Civic 11th Generation 2022 2023

0 out of 5₨60,000₨48,000 -

-

-

-

Modifications, Body Kits, Suzuki-Swift-2022

Buy Suzuki Swift OEM Body Kit 2022-2023

₨69,0000 out of 5 -

Honda-Civic-2016-2021, Body Kits, Modifications

Honda Civic Body Kit FC450 V3 2016-2021

₨83,0000 out of 5 -

-

Honda-Civic-2022, Body Kits, Modifications

Buy Honda Civic Tithum Body Kit 2022-2023

₨35,0000 out of 5 -

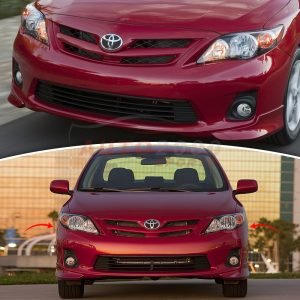

Modifications, Body Kits, Toyota-Corolla-2012-2013

Buy Toyota Corolla Body Kit 2012-2013

₨19,0000 out of 5 -

-

Buy Honda Civic Floor Mats 9D Max 2022-2023

₨12,999₨10,500

Top Brands