How to Pay Vehicle Token Tax Online in Punjab 2022 – Complete Guide

Most vehicle owners know the need to pay token tax every year but finding an efficient way to pay it isn’t as simple as it seems. If you don’t want to spend a lot of time dealing with paperwork and lines at the local administration office, we recommend you follow this step-by-step guide on how to pay vehicle token tax online in Punjab. All you need to do is complete and submit your form on time and pay your token tax directly from your bank account, completely hassle-free! So, without further ado, let’s get started!

Why you should pay the vehicle tax online

Whether you’re a business or a private individual, paying the vehicle token tax online ensures that your vehicle is registered with the authorities. There are two ways to do this: through an electronic service or the old method of filling out a paper form. If you have a purchase receipt for the vehicle in question, then it’s best to use an electronic service like Net banking or an e-pay app.

This is because doing so guarantees that your tax will pay and add straight to your vehicle registration card. If you go down the route of using a paper form. There’s always the chance of some mistakes along the way. For example, if you don’t fill out all the details correctly on the vehicle token tax form, this can lead to administrative charges and delays in processing. Therefore, you’ll avoid delays and additional costs by using vehicle token tax online in Punjab.

How to Pay for Vehicles Online in Punjab?

Vehicle tax is a state obligation that may be eligible for an exemption if certain conditions are met. Your revenue department needs vehicle tax remittance every year. There are several ways you can pay vehicle token tax online in Punjab, according to your convenience. The following steps will help you know how to pay vehicle token tax online in Punjab.

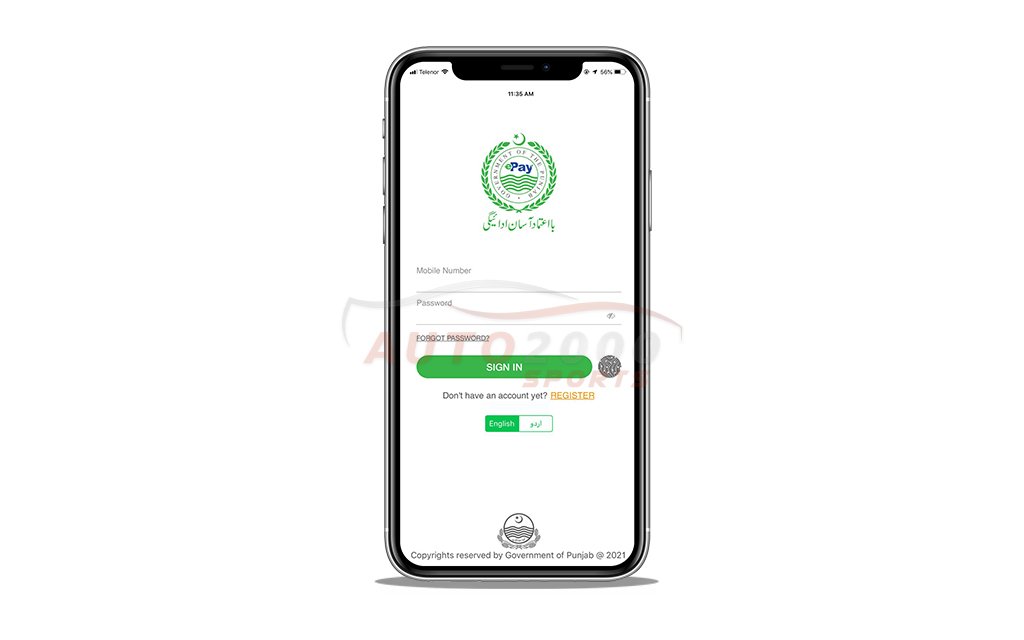

#1. Install the E-Pay Punjab App

First, download the e-pay Punjab App and install it on your smartphone. The app is available for both Android and iOS operating systems. This app will provide you with all the information you need to pay vehicle token tax online in Punjab by taking you through each process step.

#2. Register yourself

If you are paying vehicle token tax online for the first time, then register yourself. Provide your particulars like Name, Address, Contact Number, and Card Number. After successful registration, you will receive a password that is personal to you. For any subsequent transaction with the department, use this password.

#3. Enter details correctly

This can be done by clicking on the Add Vehicle button, where you will enter your vehicle’s number plate and proceed. Next, input your phone number, fill out your contact details, and provide a password. Once complete, an SMS notification will be sent to you with your verification code for OTP, which needs to be entered before submitting this form. Finally, hit the submit button, and your new token tax registration will be generated within seconds.

#4. Generate Payment Slip ID or Challan Form

When you enter all your detail, click the Challan number, and a PDF with the challan form will open up. Please fill it out accordingly and print out a copy for your records. The payment slip id is generated automatically, so you don’t need to fill that portion of the challan form.

#5. Select Payment Options

After submitting all information and generating the payment slip ID, you must select the payment option. There are some types of payments available:

The first is the online payment with your bank app (internet banking), which is the fastest way to make payments. You can also pay it through ATM. The second is offline payment at any branch of the State Bank of Pakistan (SBP) by cash or bank account. Offline payments can take time, so it’s better to make online payments when possible.

FAQs

How to pay Vehicle Tax Online using Islamabad City App?

Vehicle taxes are a set fee that owners must pay every year. If you live in Islamabad, you can pay your vehicle tax online by downloading the Islamabad City App on your smartphone and following these steps:

- Open the app and select Vehicle Tax from the menu.

- Enter your vehicle registration number (license plate) or mention your vehicle’s make and model.

- Select how many years of Vehicle Taxes you would like to pay (1, 2, or 3).

- Click on Pay Now.

- Provide some basic personal information and click on Submit.

How can I check my Punjab car Token online?

The website and app of Punjab Car & Bike Universal Numbering System offer ways to check the status of your vehicle’s tax. You can get complete detail of taxes through their app. You can also visit their website for further information on paying vehicle token tax online in Punjab. In short, car owners must register their cars with the state government. After registering, they will give a Punjab car number or universal number, which they should affix onto their vehicles as soon as possible. A significant advantage of having a Punjab car number is that it helps avoid confusion regarding who owns a particular vehicle in case it stole.

Also Read: